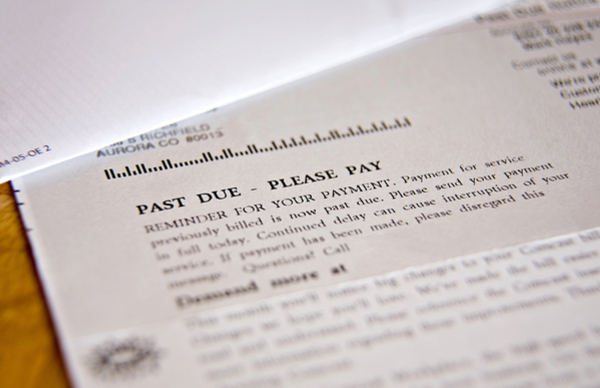

Thinking of Hiring a Debt Collection Agency?

…Consider these Issues First

Debt collection is not an industry that people tend to think of highly. After all, most people want to hear from a debt collection just about as much as they want a reminder from their dentist that they are due for their next cleaning. In addition, there are countless reports of debt collection agencies that engage in unethical or even illegal tactics when they are attempting to collect from debtors, tarnishing the reputation of the entire industry.

In reality, debt collection provides a valuable service to society by encouraging parties to fulfill their legal obligations, and most debt collection agencies engage in practices that are ethical in compliance with the relevant rules and regulations.

If you are in business and considering hiring a debt collection agency, it is understandable that you want an agency that is effective and will represent your business interests professionally and legally. Here are three steps to take before retaining an agency to help you collect your debts.

Research the Company

One of the first things to do is to simply gather as much information about the company as possible. Go through their website and read about their services and methods. If you live in a state in which debt collection agencies need to be licensed, make sure that they are and double check their licensure status with appropriate state agency. In addition, check to see if the company has been the subject of any legal action or has had complaints against it filed with the Federal Trade Commission.

Determine their Fee Structure

Make sure that you fully understand the way in which the agency charges for debt collection services. Common arrangements include a flat-fee per successful collection or a percentage of the total amount collected. Some agencies may also impose up-front fees or signup charges, so be sure to fully evaluate an agency’s fee structure before retaining them to collect a debt.

Determine if They are a Good Fit for You

Collection agencies can vary greatly in the way they operate. In addition, collection techniques can vary significantly from industry to industry. Make sure that the way the agency operates fits with your communication preferences and has experience collecting debts similar to those on which you are trying to collect.

Call 800-223-6259 today for more information

If you are having difficulties collecting on your business debts, you should call CMCS today. Since 1984, we have helped businesses in a wide variety of industries, including manufacturing, equipment leasing, staffing, automotive aftermarket, energy, telecommunications, insurance, and personal collection. To start the process of collecting on your business’s bad debts, call CMCS today at 800-223-6259 or contact us online.