30

Aug

10

Aug

Banks to be Affected by CFPB Plan

The Consumer Financial Protection Bureau (CFPB) recently proposed a new regulatory scheme that may have an upmarket effect on banks who use third-party debt collectors. While ...

03

Aug

Tips to Avoid Getting Short Changed By Debtors

Running a small business is risky business—with so many failing in their first few years, it’s easy to despair when bills are due are not being paid, facing yourself with ...

26

Jul

Ask The Right Questions of a Customer Proposed Payout Plan

If your customer comes to you looking for a payout plan, you need to be careful before you sign off on any plan they have proposed themselves. Be sure to fully read and unders...

20

Jul

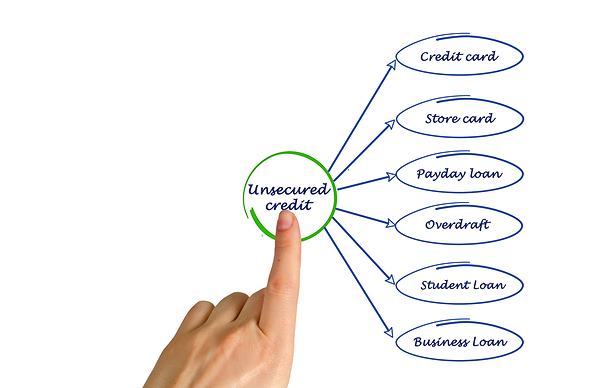

Factors Affecting Collectability of Unsecured Debt

Perhaps unsurprisingly, unsecured debt can be much more difficult to collect that secured debt. This does not mean that you should write any past-due uncollected receivables o...

12

Jul

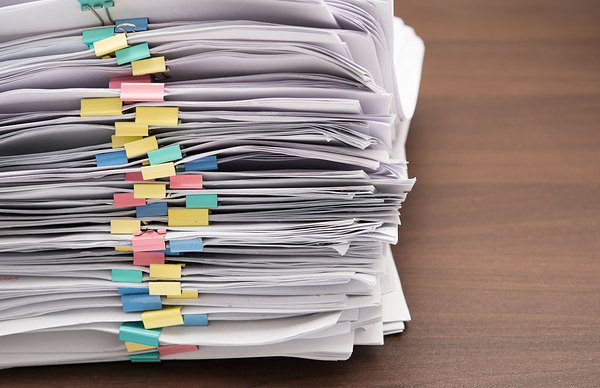

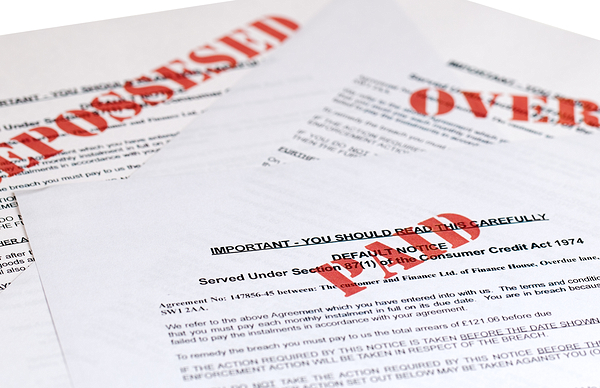

9 Documents to Help Ease the Pain of Collections

If you are having trouble collecting a business debt and are sending the account to collections, you should make sure to provide the collector with all of the relevant documen...

06

Jul

Reasons your Client Hasn’t Paid You Yet

If you are new to collections, it may come as a surprise that turning an account over to a collection agency does not mean that the issue will be immediately resolved. Below a...

28

Jun

Debt Collection FAQ

Effective management of your accounts receivable portfolio is essential to the success of any business. Unfortunately, there are situations in which clients or customers simpl...

20

Jun